Voting Policy(for Domestic stocks)

Daiwa Asset Management Co. Ltd.

Our corporate philosophy is to contribute toward social and economic development through financial and capital markets, and we believe that the exercise of voting rights can play a very important role in this purpose. We have made public the details of DAM’s Proxy Voting Policy, so that all stake-holders are familiar with the Policy. We feel that helping investee companies to understand the reasons behind decisions as to whether or not to vote in favor of particular proposals can make a positive contribution toward constructive engagement with them.

Ⅰ.Basic Policy for Proxy Voting

1.Basic Policy for Proxy Voting

We fulfill our fiduciary duty by exercising voting rights to enhance the medium- and long-term value and sustainability of investee companies in consideration of minority shareholder interests.

In principle, we exercise voting rights on the stocks of all investee companies without distinguishing between active and passive investments.

We have established the Stewardship Committee, composed of personnel from the Fund Management Division whose roles are related to stewardship activities, under the direction of the Chief Investment Officer (CIO). Pros and cons of voting rights are determined independently by us based on the criteria established by the Stewardship Committee (hereinafter referred to as the "Criteria").

2.Basic Guidelines for Proxy Voting

We will vote in favor when deemed appropriate from the viewpoint of enhancing medium- and long-term corporate value or protecting minority shareholder interests.

In order to contribute to constructive dialog with investee companies, the Criteria are prepared as clear as possible with the aim of enhancing objectiveness and careful explanation.

The Criteria will be continuously reviewed and revised as necessary to contribute to the investee companies’ corporate value and sustainable growth, reflecting the knowledge obtained through constructive dialog with investee companies, as well as changes in the social, economic and political situations surrounding the company and its business environment etc.

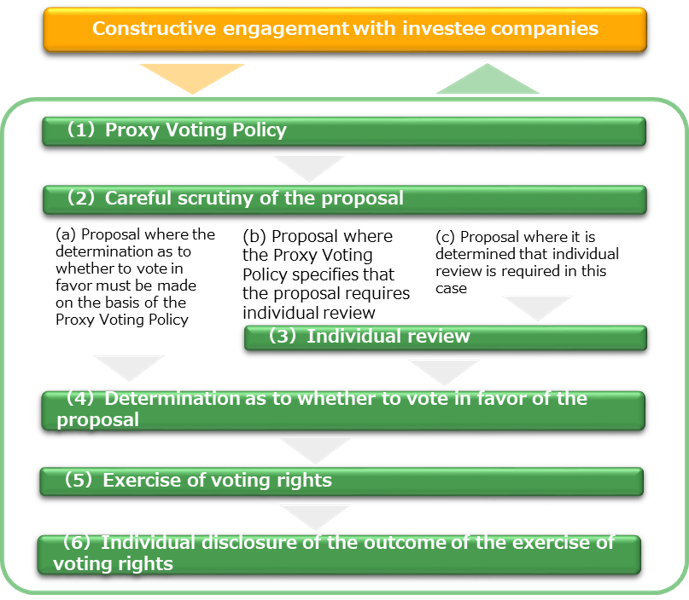

3.Decision-making Process for Proxy Voting

We will decide whether to approve or disapprove the proposals based on the Criteria and exercise voting rights.

However, the Stewardship Committee shall decide whether to approve or disapprove the proposals independently of Criteria, based on constructive dialog with the investee company and other factors, if, due to changes in economic and social conditions and the individual circumstances of the company concerned, the application of the Criteria is not expected to contribute to the fulfillment of the fiduciary responsibility or to the enhancement the medium- and long-term value and sustainability of investee company.

For those proposals for which Criteria for approval or disapproval cannot be defined in advance in a categorical or uniform manner due to the highly individualized nature of the proposal or for other reasons, the Stewardship Committee will deliberate and decide whether to approve or disapprove such proposals on an individual basis.

The Stewardship Committee will treat the voting rights as special cases when exercising the voting rights for securities issued by companies with a capital relationship (DAM’s affiliates including Daiwa Securities Group Inc., etc.) or business relationship (companies that are distributors of our Investment Trusts, and their parent companies), as it may lead to conflict of interest. For proposals by these companies which should be decided independently of the regular criteria, we will exercise the voting rights based on recommendations given by the external proxy advisors, so as to avoid conflict of interest and ensure the neutrality of the decision. However, if the Stewardship Committee determines that it is not appropriate to follow such recommendations from the viewpoint of enhancing corporate value and minority shareholders’ interests, it shall decide whether to approve or disapprove the proposals independently. Contents of voting exercised with regard to companies subject to conflict of interest management shall be regularly reported to the Stewardship Supervisory Committee (the “Supervisory Committee”), composed of the Outside Directors and the Chief Compliance Officer, who is responsible for managing conflicts of interest. The Supervisory Committee shall strive to eliminate conflicts of interest and ensure neutrality by making recommendations to the CIO in cases where it has determined that there is a problem with conflict of interest management. The Stewardship Committee may receive advice from the Supervisory Committee before individual deliberations or decisions by the Stewardship Committee, at the request of the Stewardship Committee.

Ⅱ.Criteria for Executing Voting Rights

1.Domestic stocks

We shall carefully examine all proposals and exercise voting rights of the domestic investee companies based on the following criteria. Provided, however, that depending on an investee company’s current circumstances and the content of constructive dialog (engagement) with the investee companies, based on the adoption of a perspective that emphasizes enhancing the medium- and long-term value and sustainability of investee companies, the decisions made by us may differ from those indicated by the following criteria.

(1) Appointment of Directors (excluding Outside Directors)

We will vote against the reappointment of directors (excluding outside directors) of companies in any of the following cases.

1) The reappointments of the candidates for the company judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust, and who are deemed to have responsibility for said events. While said companies shall be reviewed individually, when doing so a comprehensive judgement shall be made from the perspective of whether they have subsequently put in place sufficient internal control systems, and the impact on performance or corporate value and/or social responsibility.

2) The reappointments of candidates who served longer than the last three fiscal years, during which it has been deemed inappropriate in terms of the past earnings results or capital allocations (in case of companies with nominating committee etc., including the term of service as executive officers). Provided, however, that some business categories may be exempted.

(*) The criteria for determining inappropriate in terms of the past earnings results or capital allocations are any of the following conditions:

·Condition 1: Companies that have made losses for the past three consecutive fiscal years and which have a Price-to-Book ratio, PBR of less than one times at the end of the most recent fiscal year. Net profit attributable to shareholders of the parent company is used to determine whether or not the company is running at a loss.

·Condition 2: Falling under any of the following criteria (i) – (ii) and also falling under the criteria (iii).

(i) Companies whose Return on Equities, ROEs for the last three fiscal years are all below the low 33% level of the same industry group ranking. Provided, however, that it may be exempted for companies whose ROE has been on the uptrend in the last two terms;

(ii) Among companies whose ROEs have been declining for the last two consecutive fiscal years and whose ROE for the most recent fiscal year is below the low 33% level of the same industry group ranking, those that are judged to have problems;

(iii) Companies whose PBR (based on the latest fiscal-year-end) has been falling below the low 33% level of the same industry group ranking.

·Condition 3: Falling under any of the criteria (i) - (ii) of Condition 2 and the Investor Relations, IR activities are deemed to be extremely inadequate.

(*) The criteria for determining that IR activities are extremely inadequate are companies that have no voluntary IR activities other than statutory disclosure.

(Notes) The industry classification is based on the TOPIX-17 Series by the Tokyo Stock Exchange.

In addition, we will vote against the reappointment of the Representative Directors (or Representative Executive Officers) of companies in any of the following cases.

3) The reappointments of candidates who are representative directors (or representative executive officers) of a company for which two or more outside directors who meet the independence requirements of our standards (“independent outside directors”) have not been appointed (submitted). For companies listed on Prime Market of the Tokyo Stock Exchange, those for which two or more independent outside directors have not been appointed (submitted) and one-third or more of the board is not comprised of independent outside directors.

4) The reappointments of the candidates who are representative directors (or representative executive officers) of a company which has a parent company or controlling shareholder, where two or more independent outside directors have not been appointed (submitted) and one-third or more of the board is not comprised of outside directors. For companies listed on Prime Market of the Tokyo Stock Exchange, those for which two or more independent outside directors have not been appointed (submitted) and a majority of the members of the board is not comprised of independent outside directors.

5) The reappointments of the candidates who are representative directors (or representative executive officers) and appointed as directors for three consecutive fiscal years of the company, which has been deemed insufficient in terms of capital allocation while maintaining excess capital and cash, and has a low dividend payout ratio, and does not show the improvement in terms of its usage of capital.

Provided, however, that the following companies are excluded.

(i) Companies for which proposals for surplus disposals are being put on agenda at the same time;

(ii) Companies belonging to the financial sector. Even in other industries, there are cases where companies with a high ratio of finance-related business may also be excluded.

(*) The criteria for maintaining excess capital or cash, low dividend payout ratio and insufficient capital allocation are the following all three conditions. We will monitor companies that fall under these criteria and will decide whether they are improving or not.

·Condition 1: The capital adequacy ratio is 50% or more and net cash is at least 30% or more of total assets;

·Condition 2: The Dividend on Equity (DOE) is less than 2%;

·Condition 3: Companies whose ROE is below the top 33% level of the same industry group and it does not exceed 8% (excluding companies falling under “2)” above) for the past two out of the last three fiscal years.

6) The reappointments of the candidates who are representative directors (or representative executive officers) of the company which introduced and continued to adopt takeover defense measures by resolution of the Board of Directors.

7) The reappointments of the candidates who are representative directors (or representative executive officers) of the company whose disclosure is not adequate (such as business reports at an ordinary general meeting of shareholders and information necessary for the decision of proposals is not disclosed).

8) The reappointments of the candidates who are representative directors (or representative executive officers) of companies listed on Prime Market of the Tokyo Stock Exchange, for which at least one female officer (directors and corporate auditors under the two-tier board) has not been appointed (submitted).

9) The reappointments of the candidates who are representative directors (or representative executive officers) of companies holding excessive strategic shareholdings, and which cannot be judged to have made sufficient efforts to reduce those strategic shareholdings.

(*) Standard for determining that a company is holding excessive strategic shareholdings is a company the amount of whose strategic shareholdings (including deemed shareholdings) are 20% or more of net assets. However, even if they amount to less than 20%, reappointment may be opposed in the event it is determined that particular problems exist with efforts to reduce those holdings.

10) The reappointments of the candidates who are directors (or representative executive officers) of companies dealing with major issues regarding ESG, etc. and where improvements are not seen despite ongoing attempts at engagement, or which do not respond to repeated requests for engagement.

(2) Appointment of Outside Directors

We will vote against the candidates who fall under any of the following criteria.

1) The reappointments of the candidates for the company judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust, and who are deemed to have responsibility for said events.

(*) See “(1) Appointment of Directors (excluding Outside Directors)” 1) regarding determination of said companies.

2) Candidates judged as having problems with regard to the independence.

(*) It would be on the issue only when the majority of the Board of Directors does not consist of independent outside directors, and the criteria with regard to the independence of candidates are falling under any of the following conditions.

·Condition 1: Not stated as "met the requirements of independent officers" of the Financial Instruments in the notice of general meeting of shareholders;

·Condition 2: Officers (excluding non-executive directors and corporate auditors) or employees of the major shareholders (holding 10% or more stake) and their parent company, subsidiaries and affiliate companies (Provided, however, that if the candidates have retired more than 5 years ago, the Condition will not be applied);

·Condition 3: Candidates who have long term tenure as Directors (those having served a total of 12 years or more as of the general meeting of shareholders).

3) Candidates judged as having problems with regard to the attendance at the Board of Directors.

(*) The criteria for judging the issues with regard to the attendance at the Board of Directors are any of the following conditions.

·Condition 1: Reappointment candidates whose attendance rate at the Board of Directors is less than 75%;

·Condition 2: Reappointment candidates for which clear information on attendance rates is not disclosed.

(3) Appointments of Corporate Auditors (excluding Outside Corporate Auditors)

We will vote against the reappointment of the candidates for a company judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust, where the candidates are deemed to have responsibility for said events.

(*) See “(1) Appointment of Directors (excluding Outside Directors)” 1) regarding determination of said companies.

(4) Appointments of Outside Corporate Auditors

We will vote against the candidates who fall under any of the following criteria.

1) The reappointments of the candidates for the company judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust, and who are deemed to have responsibility for said events.

(*) See “(1) Appointment of Directors (excluding Outside Directors)” 1) regarding determination of said companies.

2) Candidates judged as having problems with regard to the independence.

(*) It would be on the issue when the candidates are falling under any of the following conditions.

·Condition 1: Not stated as "met the requirements of independent officers" of the Financial Instruments in the notice of general meeting of shareholders;

·Condition 2: Officers (excluding non-executive officers and corporate auditors) or employees (including retirees) of the major shareholders (holding 10% or more stake) and their parent company, subsidiaries and affiliate companies (Provided, however, that if the candidates have retired more than 5 years ago, the Condition will not be applied);

·Condition 3: Candidates who have a long term tenure as Corporate Auditors (12 years or more tenure as of the general meeting of shareholders).

3) Candidates judged as having problems with regard to the attendance at the Board of Directors.

(*) The criteria for judging the issues with regard to the attendance at the Board of Directors are any of the following conditions.

·Condition 1: Reappointment candidates whose attendance rate at the Board of Directors or the Board of Auditors is less than 75%;

·Condition 2: Reappointment candidates for which clear information on attendance rates is not disclosed.

(5) Appointments of Directors who are Members of Audit and Supervisory Committee or Audit Committee

We will apply the criteria according to the policy of appointing Corporate Auditors.

Besides, on the criteria for judging the issues with regard to the independence of candidates for Outside Directors, see the conditions of 2) in the “(2) Appointment of Outside Directors” .

And in the following criteria, when stated as "Corporate Auditors", it includes Directors as members of Audit and Supervisory Committee or Audit Committee.

(6) Appointments of Candidates for Officers at Vacant Positions

We will respect the proposals from the company.

(7) Appointments of Accounting Auditors

Cases in which a company has been judged to have experienced significant events in terms of accounting or financing that impair corporate social trust in the company or the company’s officers and employees will be considered on an individual basis.

(8) Executive Compensations

1) Establishments and Revisions of Executive Compensation

We will vote against the proposals to increase the amount of executive compensation per person for companies which fall under any of the following criteria (except in the case of setting the amount of compensation for directors who are Audit and Supervisory Committee members through the transition to a company with an Audit and Supervisory Committee).

(i) Companies judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust.

(ii) Companies determined inappropriate in terms of the past earnings results or capital allocations. Provided, however, that compensation for Corporate Auditor is excluded. Some business categories may be exempted.

(*) See the conditions 1 through 3 of “(1) Appointment of Directors” 2) on the criteria for determining inappropriate in terms of the past earnings results or capital allocations.

2) Executive Bonuses

We will vote against the proposals which fall under any of the following criteria.

(i) When a company is judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust.

(ii) Companies determined inappropriate in terms of the past earnings results or capital allocations. Provided, however, that some business categories may be exempted.

(*) See the conditions 1 through 3 of “(1) Appointment of Directors” 2) on the criteria for determining inappropriate in terms of the past earnings results or capital allocations.

(iii) Payments to Outside Directors or Outside Corporate Auditors.

3) Payments of Retirement Benefits for Executives

In principle, we will vote against the proposals unless the termination of the payments of retirement benefits is proposed at the same time.

4) Adoptions or Revisions of Performance-Linked Compensations (including monetary remuneration, stock remuneration, and stock options)

We will vote against the proposals which fall under any of the following criteria.

(i) When dilution of share value is involved;

(*) Criteria judging significant dilution of share value are subject to any of the following conditions:

·Condition 1: When dilution is 5% or more of the total number of shares outstanding;

·Condition 2: In the case of ongoing annual issuance of shares, when dilution of the total number of shares outstanding is 1% or more per year.

(ii) when the applicable persons are deemed inappropriate.

(*) Criteria for judging that persons to be granted are deemed inappropriate are subject to any of the following conditions:

·Condition 1: Payments to Outside Directors or Outside Corporate Auditors;

·Condition 2: Payments to Business Partners (except when the purpose of the grant is acquisition related or third-party allocations of shares).

5) Adoptions or Revisions of Non-Performance-Linked Compensations

We will decide the proposals which grant non-performance-linked compensations to Corporate Auditors or Outside Directors, considering the following items.

・Whether there is a clear selection of targets, such as inside or outside directors, executive or non-executive directors, and whether it is clear that there is no performance-linked portion of corporate auditors or outside directors;

・Whether the ratio of stock-based compensation is limited;

・Whether there is a system to hold shares until the time of retirement from the executives;

・Whether the shares to be delivered are significantly anti-dilutive.

(9) Appropriation of Surplus

If the shareholder proposals are submitted at the same time, we will consider the proposal independently (considering the growth potentials from utilizing the retained earnings), and if there are no shareholder proposals, we will vote for the proposals in principle. Provided, however, that we will vote against the cash dividend proposals for ordinary stock which fall under any of the following criteria.

1.For companies with financial concerns

(*) Criteria for judging the companies with financial concerns are those that are making losses for the past three consecutive fiscal years, or those that have a capital ratio of 10% or less and a dividend payout ratio of 100% or more (including companies which pay dividends while making losses, except for financial industries)

2. Companies which have been deemed insufficient in terms of capital allocation while maintaining excess capital and cash, and has a low dividend payout ratio, and does not show the improvement in terms of its usage of capital.

(*) See the condition of “(1) Appointment of Directors” 5) on the criteria for maintaining excess capital or cash, low dividend payout ratio and insufficient capital allocation are the following all three conditions.

(10) Reverse Stock Splits

We will vote against the proposals if there are concerns that substantial dilution of the share value may occur (excluding proposals aimed at squeeze-out).

(*) Criteria for judging if there are concerns that substantial dilution of share value may occur are if it involves substantial increase in the total number of issuable shares and if it exceeds more than twice the current number of shares outstanding.

(11) Treasury Stock Acquisitions (Establishment of a Repurchase Limit)

We will consider each proposal independently (considering the growth potentials from utilizing the retained earnings) if the shareholder proposals are submitted at the same time.

(12) Capital Increases through Third-party Allocation

We will vote for the proposals when they are judged not to harm minority shareholders’ interests, and taking into consideration the significance and effectiveness of the capital increases, the appropriateness of the issue price and the allocated third parties, etc., with reference to the reaction of the stock market after the announcements.

Provided, however, that our decision on the proposals for the disposal of treasury stock by allotment to a third-party foundation shall be determined after considering the following points and other factors.

・Whether the allotment to the foundation, including the grant of stock options, is not 5% or more of the total number of shares outstanding;

・Whether a policy is in place that the voting rights of the shares allocated to the foundation shall not be exercised, or whether they are entrusted to a third party independent from the company or the foundation and are exercised by such third party.

(13) Mergers, Corporate Splits, Share Swaps, Share Transfers

Taking into consideration the significance and effectiveness of the merger transactions, the appropriateness of the integration ratio, etc., when there is risk of impairment of corporate value, these will be considered on a case-by-case basis.

(14) Introduction and Continuation of Takeover Defense Measures

We will vote against the introduction or continuation of pre-introduction takeover defense measures. For contingency-introduction takeover defense measures, we scrutinize the nature of these measures and base decisions individually after considering details such as the particular scheme, as well as plans to enhance corporate value on the part of both the purchaser and the investee company.

(15) Increases or Decreases in the Amount of Capital or Capital Surplus

In the case of nominal capital increases or decreases, we will vote for the proposals in principle.

(16) Mergers, Corporate Divestitures, Share Exchanges, Share Transfers

In principle, we vote for the following proposals for amendment of the Articles of Incorporation.

1) Changes relating to company profiles (e.g., change of company name, fiscal year, headquarter location etc.);

2) Addition and/or elimination of business objectives;

3) Change in the method of public notice (e.g., adoption of electronic public notices);

4) Changes in the provisions of the Share Handling Regulations (Rules);

5) Reduction in the total number of shares authorized to be issued;

6) Change in the number of shares constituting one unit;

7) Provisions on odd-lot shares (including restrictions on rights);

8) Changes related to the General Meeting of Shareholders (e.g., change of the meeting place, introduction of an Internet Disclosure System, changes in reference dates, etc.);

9) Relaxation of the quorum for special resolutions;

10) Transition to a Company with Nominating Committee, etc.;

11) Transition to a Company with an Audit and Supervisory Committee;

12) Change in the number of officers;

13) Shortening the tenure of Directors;

14) Reduction of requirements for dismissal of directors (transition to ordinary resolution);

15) Establishment and abolishment of positions;

16) Setting the effect of resolutions for appointing Substitute Corporate Auditors and its tenure;

17) Limitation of liabilities for Directors, Corporate Auditors, and Financial Auditors;

18) Delegations to Directors with regard to decisions on important business executions by the resolutions of the Board of Directors;

19) Introduction of written resolutions by the Board of Directors;

20) Allowing for General Meetings of Shareholders to be held without specifying a location;

21) Amendment or modification of the wording;

22) Other proposals that are clearly expected to contribute to enhancing corporate value of the company.

In principle, we vote against the following proposals for amendment of the Articles of Incorporation.

1) Extension of the tenure of Directors;

2) Aggravation of requirements for dismissal of Directors;

3) Introduction and continuation of Takeover Defense Measures.

Other than the above, we will apply the following criteria.

1)Expansion of total number of issuable shares

We will vote against the proposals if there are concerns that substantial dilution of the share value that impairs corporate value may occur (when it involves substantial increase in the total number of issuable shares and it exceeds more than twice the current number of shares outstanding, excluding proposals aimed at squeeze-out).

2) Dividends from surplus and treasury stock acquisitions by resolutions of the Board of Directors

We will vote against the proposals if shareholder proposal rights are excluded.

3)Issuance of Classified Shares

We will vote against the proposals if the terms and conditions of issuance and other details have not been determined or disclosed.

4) When there is a risk of impairment of corporate value, we will consider the proposals individually.

(17) Shareholders Proposals

Our criteria for exercising voting rights for the shareholder proposals depend on whether the shareholder proposals will contribute to the increase of corporate value.

In principle, we vote for the following proposals in the shareholder proposals.

1) Dismissal (refusal to reappoint) of Directors and Corporate Auditors who do not meet our Criteria;

(Refer to “(1) Appointment of Directors (excluding Outside Directors)” through “(4) Appointments of Outside Corporate Auditors”.)

Provided, however, that candidates who will retire as of the general shareholders meeting are excluded.

2) Shortening the tenure of Directors;

3) Limitation of liabilities for Directors, Corporate Auditors;

4) Requiring disclosure of the attendance rate of Outside Officers at meetings of the Board of Directors (and the Board of Corporate Auditors)

5) Withdrawal of Takeover Defense Measures;

6) Amended or eliminated Articles of Incorporation that exclude shareholder proposal decisions to appropriation of surplus;

7) Individual Disclosure of Directors' Compensation;

8) Introduction of clawback provisions;

9) Other proposals that are clearly expected to contribute to enhancing corporate value.

In addition, we will vote in favor of proposals that call for increased disclosure of information and strengthened efforts regarding climate change, respect for human rights and other ESG issues, when we deem it appropriate to do so taking into consideration the status of corporate efforts and their impact on business execution.

In principle, we vote against the following proposals in shareholder proposals on the basis that they are unlikely to contribute to enhancing corporate value or that the decision should be left up to the company involved.

1) Dismissal (refusal to reappoint) of Officers who meet our Criteria;

2) Limiting or changing the number of Directors and limiting or changing the number of Corporate Auditors;

3) Changing the handling of blank votes;

4) Demands for changes in institutional design;

5) Restrictions on the election of the Chairman of the Board of Directors;

6) Other proposals that are unclear to contribute to enhancing corporate value.

Other than the above, we will apply the following criteria.

1) We will vote against the election of Directors and Corporate Auditors except in cases where we believe their appointment has been reasonably and adequately described as contributing to the enhancement of corporate value.

2) With regard to the proposals for increasing the number of words suggested by shareholders, we will vote for the proposals if the company has restricted the number of words.

3) When there is a possibility of contributing to the enhancement of corporate value (proposal for appropriation of surplus, acquisition of treasury stock, etc.), we will consider the proposals individually.

2.J-REIT (Real Estate Investment Trust)

We shall carefully examine all proposals and exercise voting rights of J-REIT based on the following criteria. Provided, however, that depending on an investee trust’s current circumstances and the content of constructive dialog (engagement) with the investee trusts, based on the adoption of a perspective that emphasizes enhancing the medium- and long-term value and sustainability of investee companies, the decisions made by us may differ from those indicated by the following criteria.

(1) Appointment of Executive Officers

We will vote against the reappointments of the candidates if the Investment Trust or the Asset Management Company is judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust and the candidate for reappointment is judged to have responsibility for said events.

(2) Appointment of Supervisory Officers

We will vote against the reappointments of the candidates if the Investment Trust or the Asset Management Company is judged to have experienced significant events (illegal activities, antisocial actions, scandals, etc.) that impair corporate social trust and the candidate for reappointment is judged to have responsibility for said events.

(3) Appointments of Candidates for Officers at Vacant Positions

We will respect the proposals from the Investment Trust.

(4) Appointments of Accounting Auditor

We will respect the proposals from the Investment Trust.

(5) Amendment of Regulations

The decision to vote for or against the following proposals shall be determined after considering the impact on the value of investment securities and other factors.

1) Changing management fees;

2) Changing the Maximum Amount of Remuneration Paid to Officers;

3) Changing the Targets and Policies of Asset Management;

4) Changing the policy for distribution of money;

5) Changing the matters concerning Investors Meeting;

6) Changing the asset valuation method

(6) Proposal on Asset Management Contracts

We will consider it case by case (taking into consideration the risk of impairing the value of investment securities). Provided, however, that we will vote for the proposals that can be judged not to affect the value of investment securities, such as minor changes to asset management contracts.

(7) Mergers

Taking into consideration the significance and effectiveness of the merger transactions, the appropriateness of the integration ratio, etc., when there is risk of impairment of the value of investment securities, these will be considered on a case-by-case basis.

(8) Shareholders Proposals

When proposals have the potential to enhance the value of investment securities, they will be considered individually.

We will vote against proposals that cannot be deemed as having potential to enhance the value of investment securities.