What is Corporate Transformation Engagement?

Our engagment can be understood in two types: "responsible investment engagement," which encourages the achievement of certain standards such as ESG and Corporate Governance Code, and "corporate transformation engagement," which aims to propose solutions to management issues to corporate management and directly improve PL/BS/CF for corporate transformation.

Our engagement team focuses on corporate transformation engagement and promotes all initiatives that contribute to the enhancement of corporate value.

We recognize that engagement with operating companies is crucial for fulfilling fiduciary responsibilities and generating economic returns for beneficiaries.

When engaging with operating companies, we accurately grasp their overall situations and share awareness not only on the financial side but also on the non-financial side.

To enhance the medium- to long-term value and sustainability of operating companies, we believe it is important to appropriately distribute profits among all stakeholders.

With the above perspective and the Corporate Governance Code, we believe that it is essential to allocate management resources with an awareness of capital cost and profitability to achieve sustainable growth of operating companies and increase corporate value over the medium to long term.

This is the same concept as the "Measures for Realizing Management with an Awareness of Capital Costs and Stock Prices" (March 2023, Tokyo Stock Exchange).

Our team engages with companies by discussing and making proposals on capital costs and capitalization rates, as well as strategies for realizing management goals, including business portfolio reviews and the allocation of management resources such as investments in equipment, research & development, and human resources. We believe that such initiatives will encourage companies to engage in deeper thinking and analysis, thereby contributing to the enhancement of corporate value through improved management precision and behavioral change.

A unique approach to engagement

Frequent engagement with companies.

Through direct dialogue and engagement letters, we seek to encourage behavioral changes in the company's management.

We utilize original discussion papers and other materials customized to the management issues of each company that we engage with.

- Discussion papers

-

- Preparation of written proposals aimed at solving management challenges, tailored to individual companies.

- It is possible to disseminate information to those beyond the participants of the corporate's management meetings.

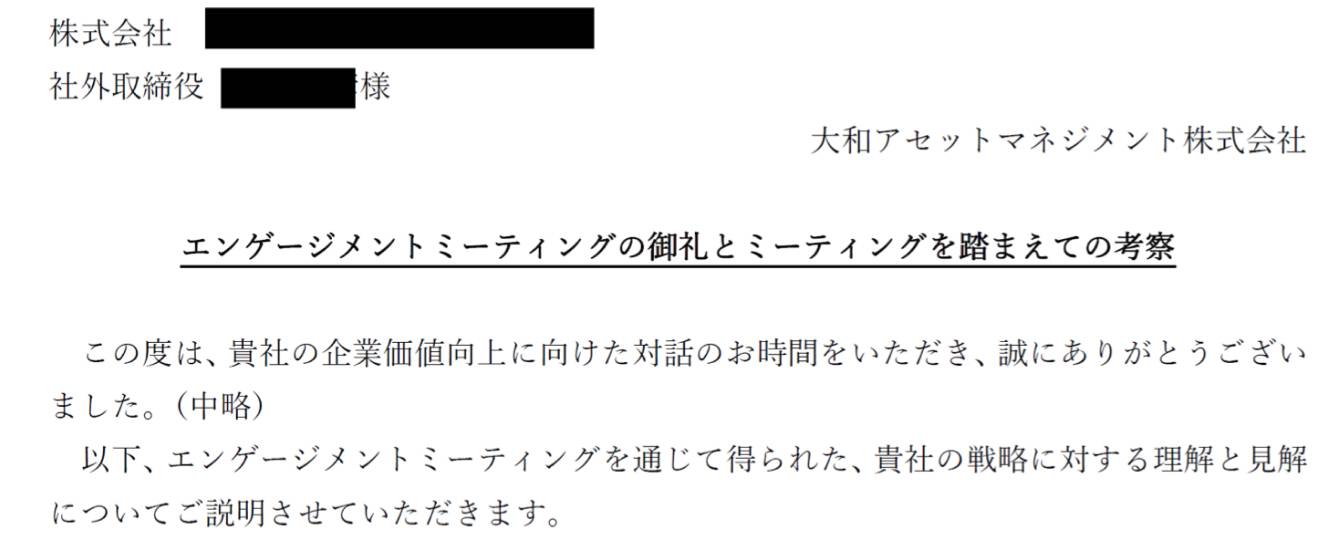

- Engagement letter

-

- Minutes of discussion

- Re-presenting counterarguments and analysis results of proposals in response to objections from companies

- Lingagement

-

- Mediating relationship building between two companies or among multiple companies

- By allowing companies faced with challenges to directly access companies that can solve them, their resolution can be expedited.

- Lecture meeting

-

- Prior to a financial results briefing, we give a lecture on how the company should convey its messages to align with market expectations.

- Proxy Voting

-

- Exercising voting rights in opposition to companies that are slow in progress

- Before and after exercising voting rights, we explain the reasons to promote the company's understanding and facilitate change.

-

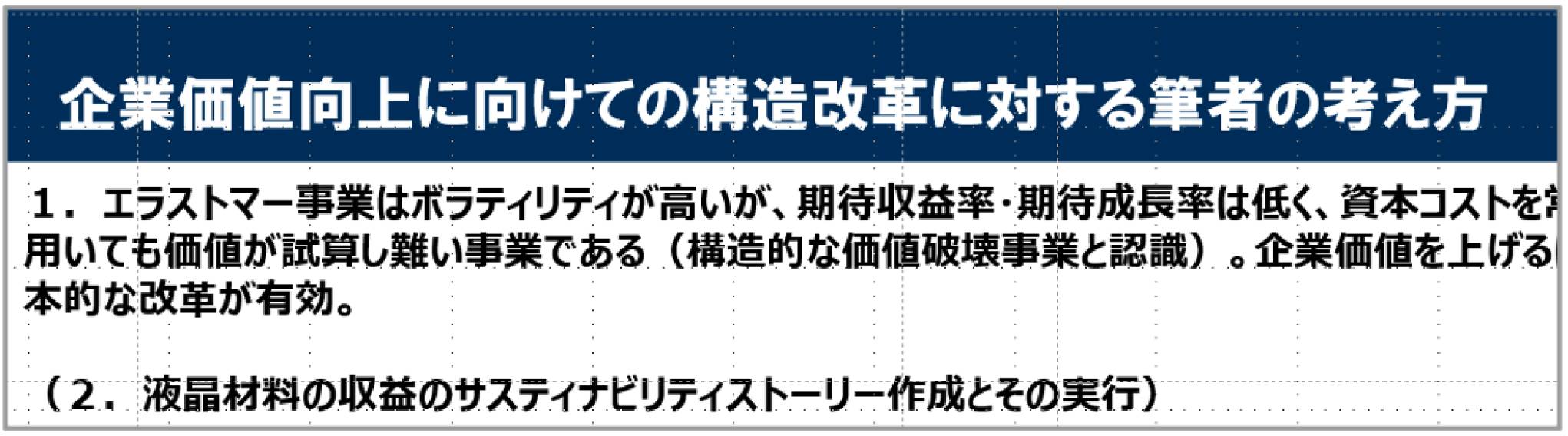

Discussion paper (excerpt)

-

Engagement letter (excerpt)

What is Lingagement?

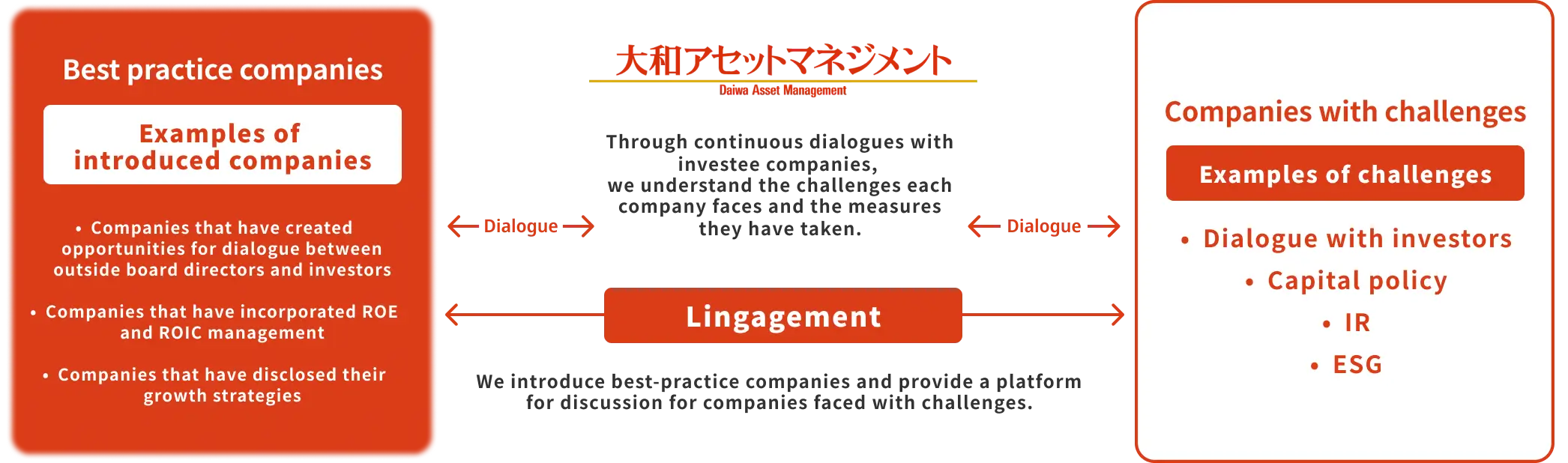

"Lingagement" refers to activities that provide investee companies with opportunities for discussions with other companies, thereby promoting knowledge sharing to support the enhancement of their corporate value.

* This is our unique term that combines "linkage" and "engagement," both of which connect companies.

The knowledge we have accumulated through various corporate analyses and dialogues, such as best practices, examples of failure, and comparisons among companies, as well as the relationships we have built up with many company stakeholders, academics, various consultants, analysts, and government officials who share our ideas, are also major strengths in our dialogues with investee companies.

Taking advantage of these strengths, we are focusing on "lingagement," where we introduce companies that have successfully navigated difficulties in improving corporate value to those facing similar challenges, facilitating knowledge-sharing.

Image of Lingagement

Mitsui Chemicals, Inc. × Multiple companies (11 companies)

Purpose: Sharing the know-how of dialogue between outside board directors and investors

The ESG trend is shifting from the stage of responding to requests and disclosure to initiatives that effectively contribute to enhancing corporate value.

For example, regarding governance, understanding how a governance process contributes to enhancing corporate value is becoming important, based on the disclosure of skill matrices and the ratios of outside directors and female directors. Meanwhile, interest in dialogue between outside directors and investors has been growing year by year. Considering that one of the roles of an outside director is to act as a spokesperson for the capital market, this is a welcome trend, and we believe that the demand for this role will become increasingly strong in the future.

On the other hand, from the perspective of operating companies, many of them seem hesitant to create opportunities for dialogue between outside directors and investors due to concerns about imposing burdens on outside directors and the fact that outside directors often have little experience engaging in dialogue with investors.

Therefore, we held a "lingagement" event with multiple companies centered around Mitsui Chemicals, Inc., to introduce the track record of Mitsui Chemicals’ “Small Meeting between Outside directors and Investors" and the insights gained from that experience to other companies, aiming to contribute to the establishment of a healthy investment chain centered around outside directors.

As a result, Company N, one of the participating companies, reaffirmed the importance of dialogue between outside directors and investors, and we received feedback from the company's senior managing director indicating that the company intends to make internal adjustments. Later, Company N also organized its "small meeting between outside directors and investors" and requested our participation in it. In this way, we are very pleased to have been able to contribute to broadening the scope of initiatives that lead to the effective enhancement of corporate value through lingagement based on the experience of Mitsui Chemicals, Inc.