ESG Integration

Believing that companies' efforts to address ESG issues lead to both the expansion of medium- to long-term growth potential and the reduction of risks, we incorporate such efforts into our investment decisions.

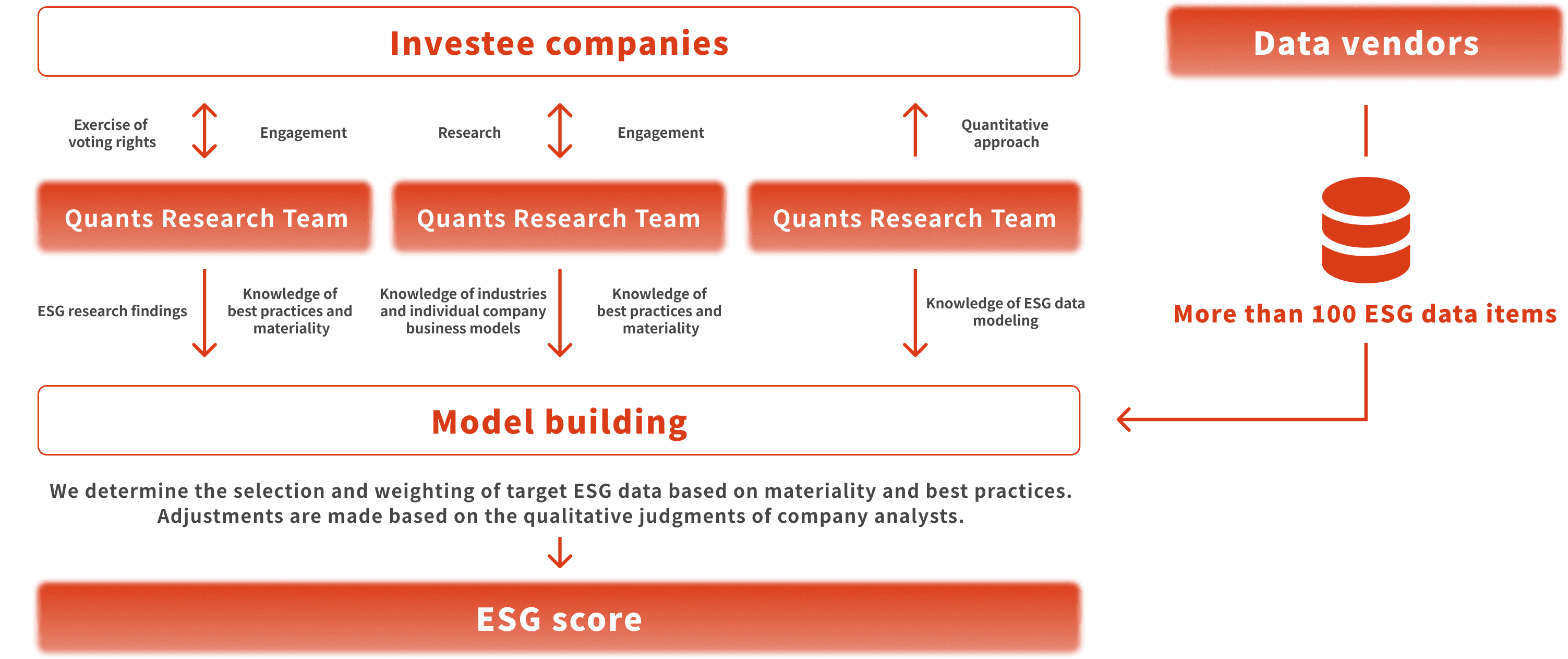

In-house ESG score

We calculate our own unique ESG scores to grasp companies' ESG-related risks and opportunities from multiple perspectives and to utilize them in our investment decisions.

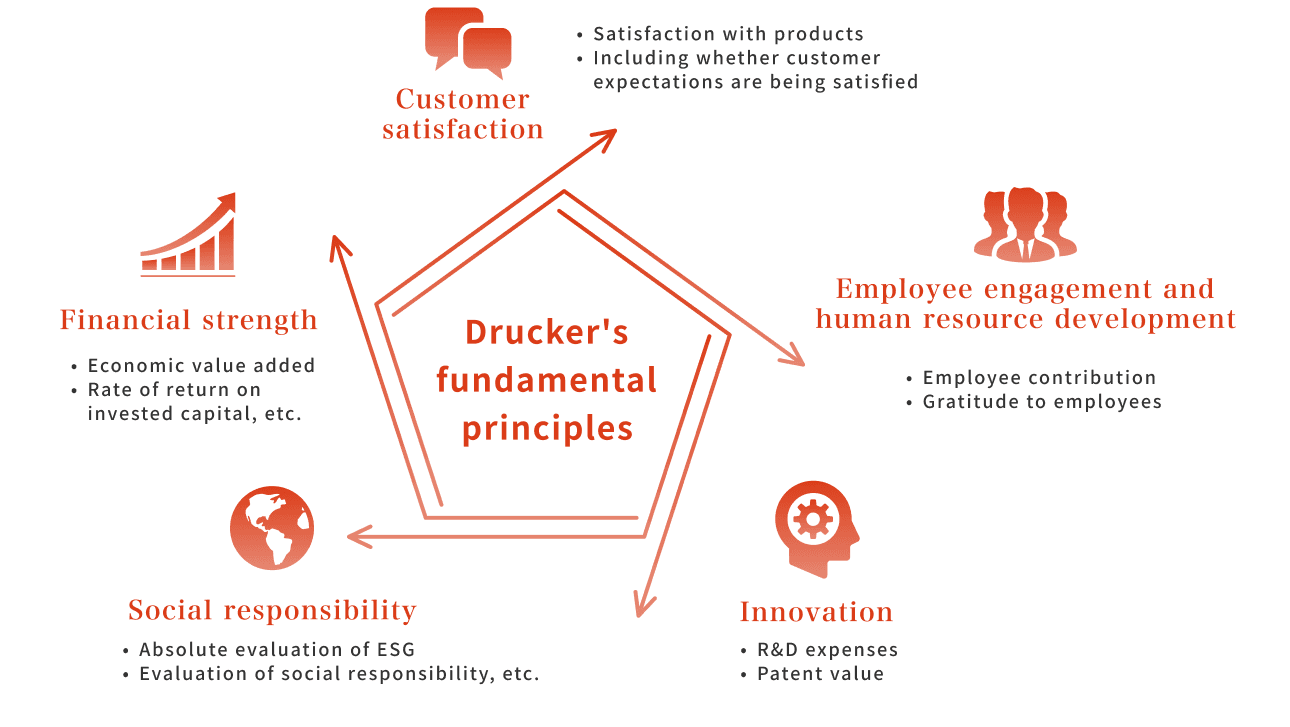

This measures "invisible power," which is a value creation source that companies possess as part of their management foundation and which is difficult to measure, regardless of financial and non-financial (including ESG) information.

Peter F. Drucker is a leading business scholar of the 20th century. He is referred to as the "greatest philosopher of the 20th century" and the "father of management," influencing many business leaders. The Drucker Institute was established at Claremont Graduate University in the United States, inheriting Drucker's ideas and ideals. The Drucker Institute not only promotes Drucker's philosophy but also quantifies as scores the fundamental principles he advocates.

The Drucker Institute Score aims to discover true growth companies by quantitatively assessing intangible assets such as employee engagement and innovation, which cannot be captured in financial statements.

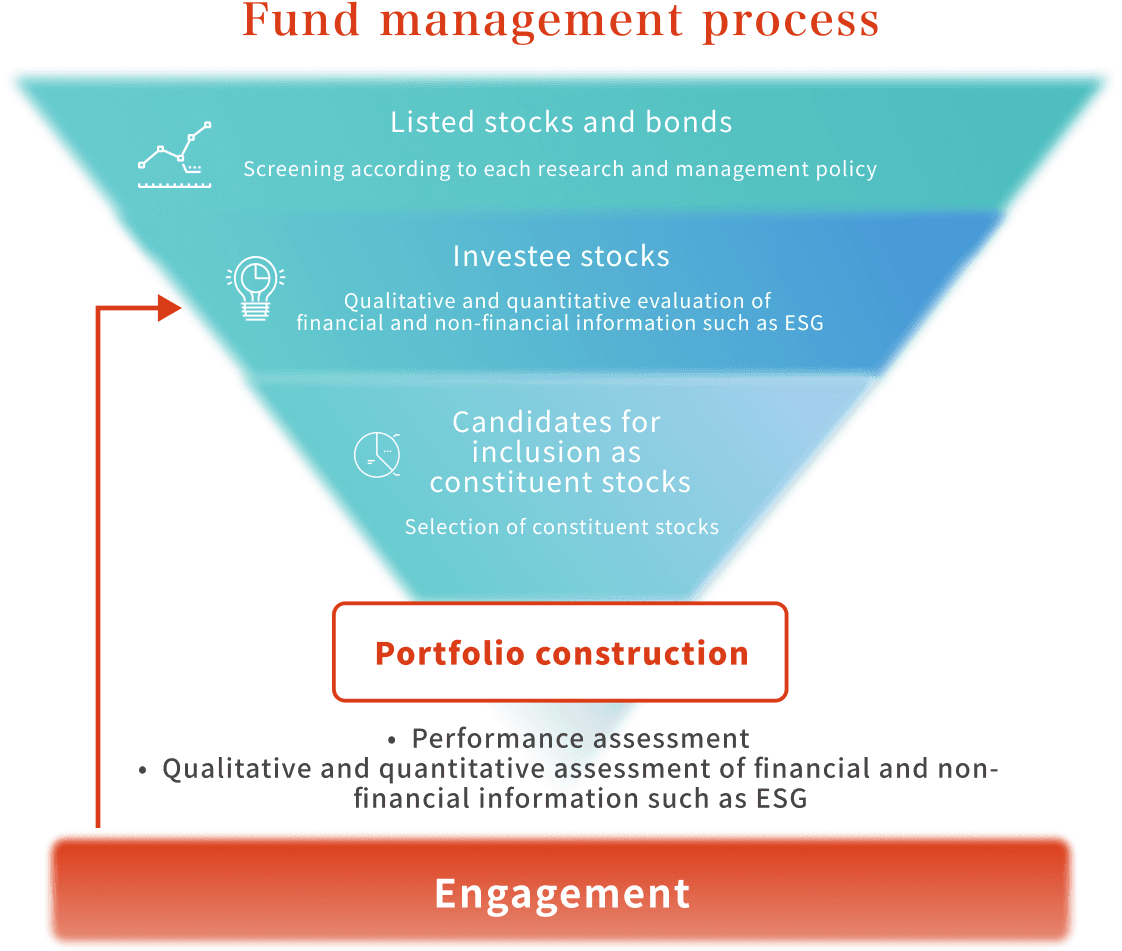

Initiatives for each asset

Based on our ESG investment policies, we will also implement initiatives that emphasize sustainability, such as ESG, for each asset.

■Stocks

- We view companies' sustainability initiatives as factors that will lead to both enhanced growth potential and reduced risk in the medium to long term. By utilizing not only financial information but also non-financial information, we will analyze and evaluate the values of investee companies.

- Through constructive dialogue, we share the management challenges faced by investee companies and their efforts to resolve such challenges, while encouraging them to improve their medium- to long-term values and sustainability.

- With regard to the right to exercise votes, we thoroughly examine whether the agenda items presented at shareholders' meetings contribute to the medium- to long-term value and sustainability of each company. We make a comprehensive judgment based on constructive dialogue and the specific circumstances of each company.

■Bonds

- We view sustainability initiatives by companies, etc. as factors that can help mitigate the downside risk of bond prices. By utilizing both financial information and non-financial information, we analyze and evaluate bond-issuing companies and entities.

- Through constructive dialogues, we share bond-issuing companies' and entities' management challenges and initiatives to address them with each company and encourage them to improve sustainability.

■Passive management

(Index, rule-based management, etc.)

- We engage in dialogues with index vendors that provide indices aimed at being linked to not only our ESG index funds but also to general index funds. We will encourage these vendors to consider sustainability factors in their index construction rules, ensure high transparency, and improve information disclosure.

- Compared to active management, passive management, such as index and rule-based management, generally involves longer holding periods and restricts the sale of investment securities. Therefore, we recognize that constructive dialogues with investee companies are even more important.

- Through constructive dialogue, we share the management challenges faced by investee companies and their initiatives to address them, while encouraging improvements in medium- to long-term value and sustainability. In doing so, we will develop a system that allows us to engage in dialogues with as many companies as possible, without limiting ourselves to investees with active management.

- With regard to the exercise of voting rights, we carefully examine whether the agenda items presented at shareholders' meetings contribute to the medium- to long-term value and sustainability of respective companies. We make comprehensive judgments based on constructive dialogues and the specific circumstances of each company.

■Outsourced management

- Regarding the initial due diligence of outsourced management companies, we check their ESG-related internal structures and policies, as well as their collaboration with various initiatives.

- Even after fund setting, we conduct regular reviews, including ongoing due diligence reviews, exchange opinions on sustainability-related issues, and check the policies of outsourced management companies.

- We engage in constructive dialogues with companies while focusing on ESG funds and regularly exchange opinions on the status of the exercise of voting rights.