Materiality in Investments

We aim to contribute to the medium- to long-term asset building

of beneficiaries through our asset management business. To

achieve this objective, materiality means an important task we

have set with the aim of improving the medium- to long-term

value and sustainability of investee companies and maintaining

the sustainability of society. To this end, we strive to

accurately grasp and share awareness of the situations not only

of companies but also of the entire industry to which they

belong.

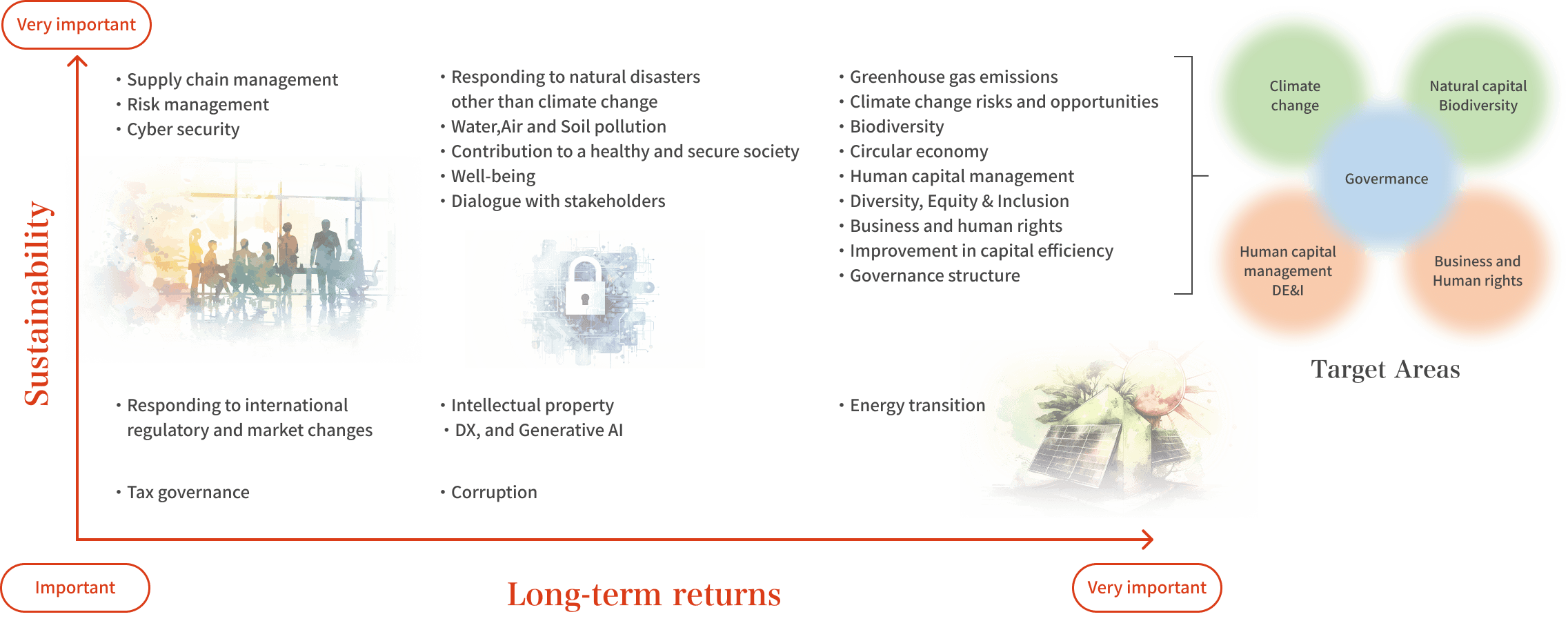

Materiality in asset management is as follows, consisting of

perspectives on ESG and other general sustainability issues. We

then analyze this materiality from two perspectives:

sustainability and long-term returns and identify high core

materiality for both.

Critical

issues

Specific points of interest

Information disclosure

Environment

Climate change

Greenhouse gas emissions

Climate change risks and opportunities

Energy transition

Natural capital

Biodiversity

Circular economy

Responding to natural disasters other than climate

change

Water,Air and Soil pollution

Society

Social responsibility

Business and human rights

Contribution to a healthy and secure society

Supply chain management

Human capital

Human capital management

Diversity, Equity & Inclusion

Well-being

Governance

Improving corporate value

Governance structure

Risk management

Cyber security

Improvement in capital

efficiency(cross-shareholdings,etc)

Dialogue with stakeholders

Tax governance

Corruption

Other perspectives related to overall sustainability

Other sustainability issues

Intellectual property

DX, and Generative AI

Responding to international regulatory and market

changes

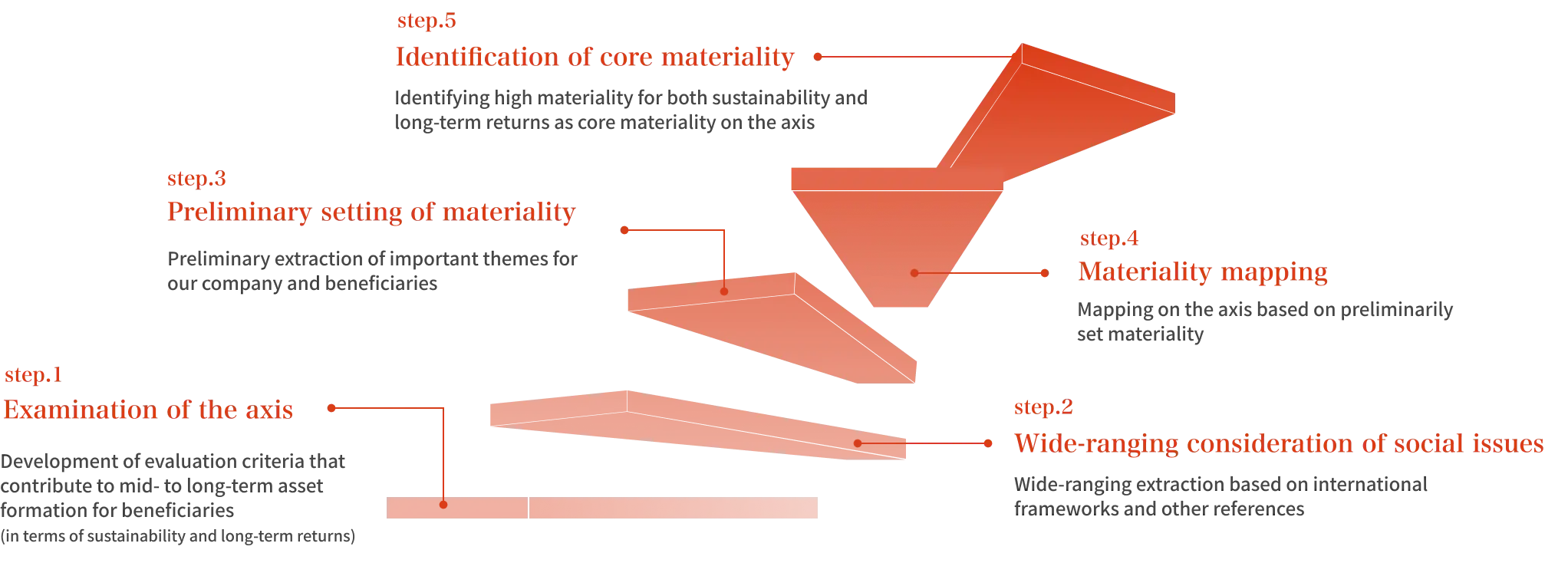

Process for identifying and

analyzing core materiality

Materiality Map

We will identify core materiality and reflect it in our engagement, voting rights exercise, and investment decisions, as well as apply it to a wide range of our business activities, including product development and sales strategies.

Climate change

We call for the identification of greenhouse gas (GHG) emissions, as well as climate change risks and opportunities, the formulation and implementation of business strategies that incorporate both aspects, and the oversight and evaluation of activity statuses.

Natural Capital

We call for our investee companies to contribute to the transition to a circular economy, identify biodiversity-related risks and opportunities, and appropriately formulate business strategies to advance nature-positive initiatives.

DE&I (Diversity, Equity & Inclusion)

We call for diversity and equal opportunity among all stakeholders of companies and for the elimination of discrimination and harassment.

Business and Human Rights

We call for our investee companies to support and respect international norms, and to appropriately address business and human rights issues not only within their own operations but also throughout their supply chains.

Improvement in capital efficiency

We call for an increase in ROE exceeding the cost of shareholders' equity and for a continuous and stable expansion of equity spread.

Governance structure

We call for the establishment of a governance structure regarding organizational design, the effectiveness of the board of directors, the role of external directors, and the executive remuneration system.

- Engagement and Proxy Voting

- ESG Integration

- Product development and sales strategies