Proxy Voting Policy

Our corporate philosophy is to contribute to social and economic development through financial and capital markets. We believe that the exercise of voting rights plays a very important role in achieving this goal.

For this reason, we have announced the details of the "policy on the exercise of voting rights" to ensure that as many people as possible understand it. In particular, we believe that having investee companies understand the reasons for our approving or disapproving decisions contributes to constructive dialogues with them.

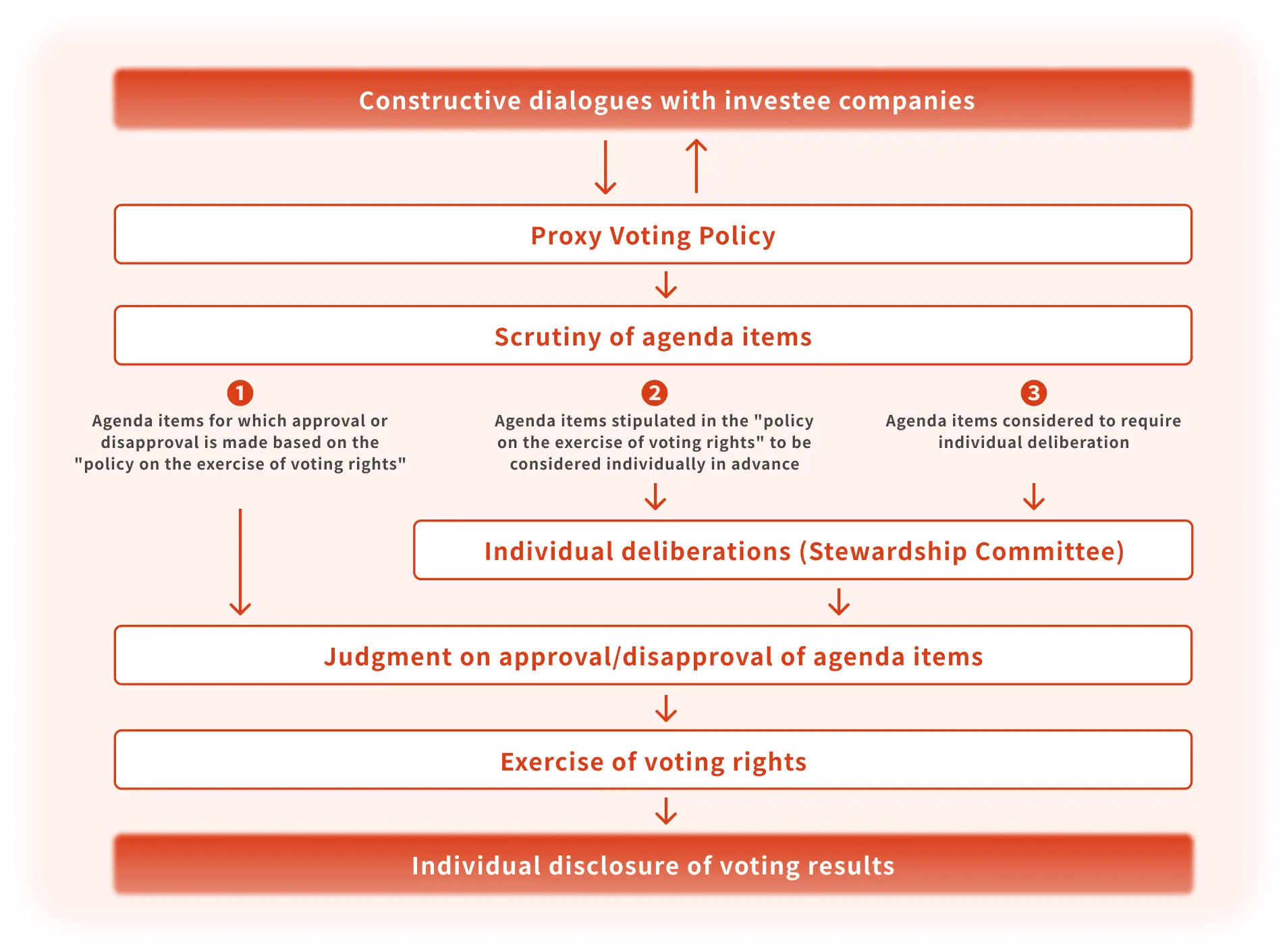

Proxy Voting Process

We exercise our voting rights based on the following process, reflecting the knowledge we gain through constructive dialogues with investee companies.

In addition, through constructive dialogues with investee companies based on the exercise policy and results, we will deepen mutual understanding and contribute to the enhancement of the value of investee companies.

Escalation Strategies

Our strives to operate in a way that integrates engagement with investee companies and proxy voting actions. Even if a shareholder meeting proposal does not conflict with the Proxy Voting Policy,we will oppose the proposal if, based on the content of dialogue and actions with the company, we determine the proposal would negatively affect its corporate value. In addition,cases exist in which we will vote in favor of a proposal after considering the content of engagement even if we would otherwise oppose that proposal if the Proxy Voting Policy were to be applied mechanically, and together define these considerations as our escalation strategies.

We thus strives to support initiatives that contribute to enhancing corporate value through dialogs with investee companies and the exercise of proxy voting rights, rather than applying the Proxy Voting Policy in a prescriptive manner.

Case Studies

of Escalation Strategies

-

Company

G

(machinery) -

Dialog theme

Financial strategy and capital

efficiency improvement- For

- Against

-

Issue recognized

-

Despite having plentiful cash reserves and equity capital, the company used funds and engaged in equity financing, the purpose of which was unclear. As a result, the company’s share price fell sharply.

-

Dialog content/

company actions -

The company explained that the purpose of the financing was to improve the liquidity of its shares and that the use of funds was intended for M&As,property acquisition, and facilities investment. Despite our insistence that the company's explanation was unsatisfactory considering its current financial standing, the discussions failed to get any closer to achieving agreement. Subsequently, the company purchased and cancelled some of the stock subscription rights, claiming that it had secured the necessary funds due to favorable business performance.

-

Reflection

in proxy voting -

Although the company's business performance and superficial governance structure do not conflict with Daiwa AM’s Proxy Voting Policy, we decided to vote against the reappointment of the director in charge of financial strategy, considering that we did not receive an adequate and convincing explanation of the financial strategy.

-

Company

H

(textiles and

apparels) -

Dialog theme

Business restructuring and

capital efficiency improvement- Against

- For

-

Issue recognized

-

The company was deemed to have issues with its branding and overseas business strategies, with significant room for improvement in terms of cost structure and capital efficiency. Fundamental business restructuring, including management reforms, are needed for the company to extricate itself from a prolonged downturn in business performance.

-

Dialog content/

company actions -

The company has initiated management changeover, as well as management reforms and downsizing of the balance sheet, occasioned in part by corporate transformation engagement which was implemented based on their recognition of the above-outlined issues from several years ago. While the company’s business conditions can be expected to be inevitably difficult until the new fiscal year due to factors such as restructuring and related costs, there are already indications that it is entering a recovery phase, and a recovery in performance can be expected from the subsequent fiscal year onwards.

-

Reflection

in proxy voting -

The company’s level of performance to date is below the lower threshold set by Daiwa AM, and application of the Proxy Voting Policy would in principle mean that we would vote against the reappointment of some of the directors. Nevertheless, we have decided to vote in favor of the reappointment of the directors in question, based on our assessment that engagement has yielded adequate results in terms of management reform by the current management team and that further improvements can be expected going forward.