JSR

Withdrawal from unprofitable businesses and evolution of the governance structure

*The elastomer business specializes in the synthesis of rubber. JSR Corporation’s synthetic rubber business leads the market in Japan, with a special strength in high-value-added synthetic rubber, particularly solution-polymerized styrene-butadiene rubber (S-SBR). However, as global competition intensified, its business environment became increasingly challenging.

Challenges

-

The elastomer business, which is the company’s core operation but facing challenges, has poor capital efficiency and low profitability.

-

Power is concentrated in the president, often resulting in delays in making painful decisions.

Proposals

-

Structural reform of its elastomer business

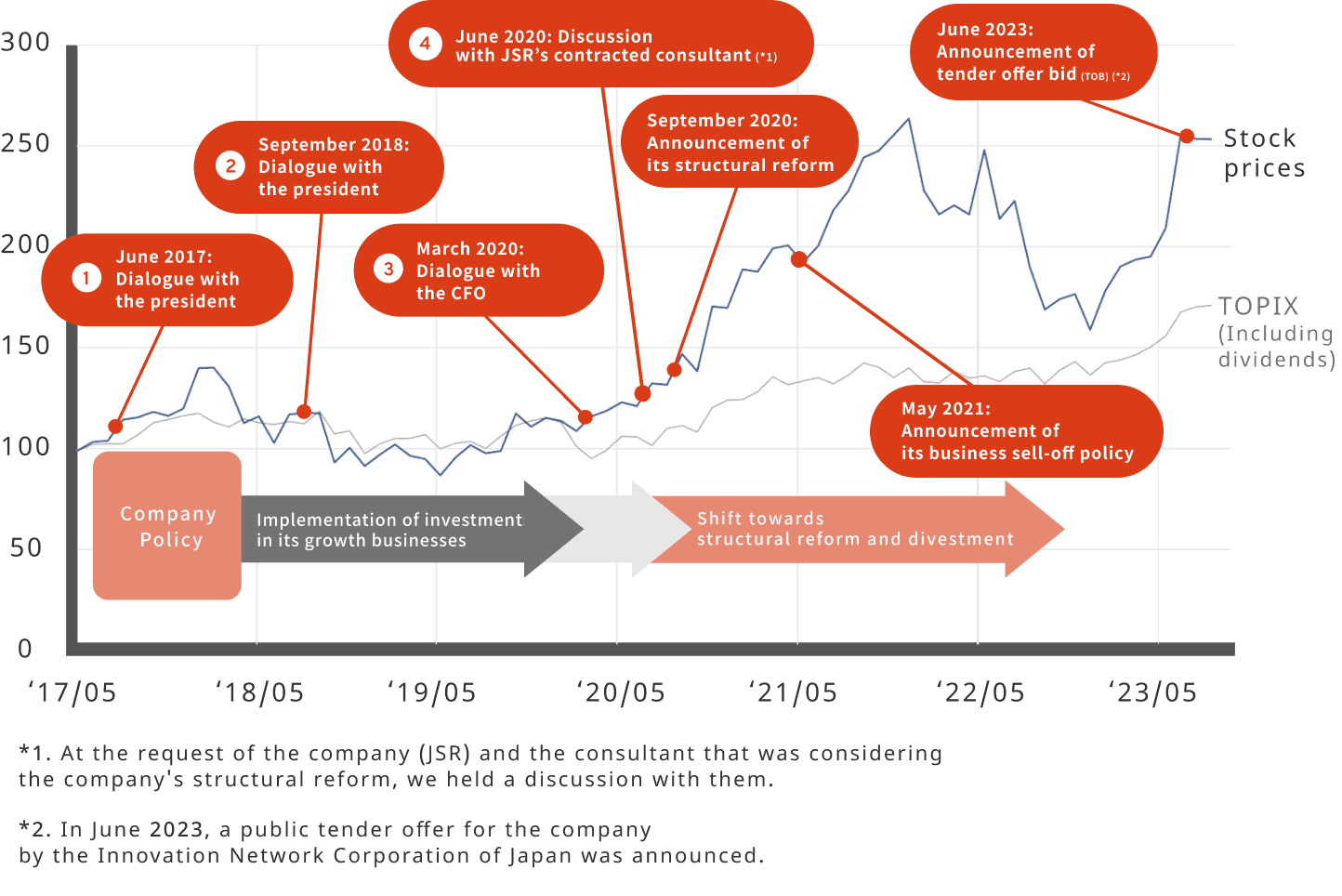

Engagement-related track record and stock price trends

End of May 2017 to end of August 2023

*Major track record only

❶ Dialogue with the president

- Daiwa Asset Management

- We pointed out the company’s low profitability and high volatility of its elastomer business as problems.

- The Company

- While acknowledging its business challenges and the necessity for countermeasures, the company insisted that its S-SBR (*) business can be expected to grow from an environmental perspective.

* Solution-polymerized styrene-butadiene rubber (S-SBR), used as a material for eco-friendly tires, was expected to see growth in demand due to rising environmental awareness and calls for improved fuel efficiency.

❷ Dialogue with the president

- Daiwa Asset Management

- We raised concerns about the fact that S-SBR has not generated profits exceeding its capital costs.

- The Company

- While recognizing the need to improve S-SBR-related earnings, the company also mentioned its potential for growth.

❸ Dialogue with the CFO

- Daiwa Asset Management

- The company focused on the growth potential of tires for environmentally friendly vehicles; however, we suggested that its synthetic rubber business should be evaluated from the perspectives of the overall growth, profitability, and environmental impact of the synthetic rubber business. Subsequently, we shared with the company the results of our scenario analysis regarding our structural reform proposals.

- The Company

- The company expressed its understanding of the need for its fundamental structural reform.

❹ Discussion with JSR’ contracted consultant

- At the request of the company, we engaged in discussions with the consultant contracted by the company to develop structural reform proposals.

- We (Daiwa Asset Management) shared the results of our business evaluation, reform scenarios, and corporate value estimates with the consultant.

Daiwa Asset Management's proposals were incorporated into the company's practical plans, leading to rapid and significant progress in the company's structural reform.

The company’s subsequent actions

・ The company mentioned the necessity of the structural reform for its elastomer business.

・ Significant strategic shift

The company announced its policy for the support measures.

September 2020

Announcement of

its structural reform

Announced a policy to transfer elastomer business to ENEOS

May 2021

Announcement of

its business sell-off policy

The public tender offer by the Innovation Network Corporation of Japan was announced.

June 2023

Announcement of TOB

Excerpt from the discussion paper used

for our engagement with the company

Based on the business evaluations, reform scenarios, and corporate value assessments performed by us, we proposed the necessity of structural reform and outlined the desired content of the reforms for the company.